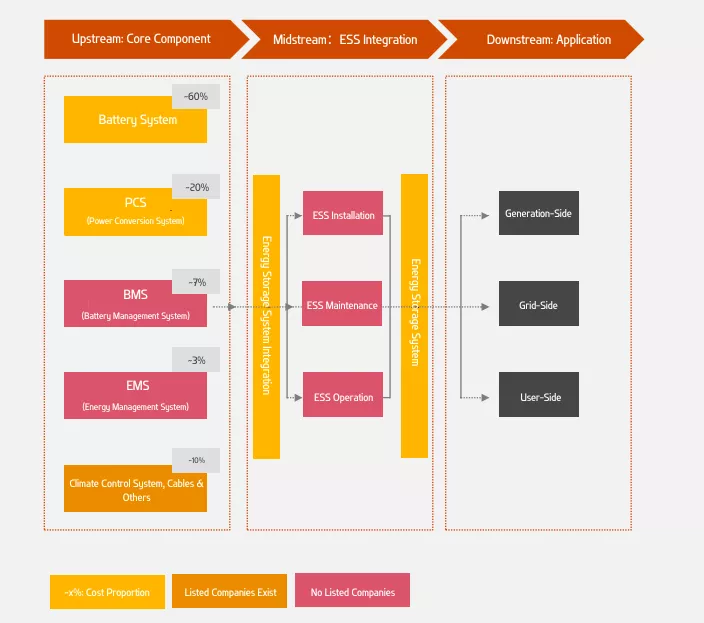

The electrochemical energy storage system industry chain mainly includes upstream equipment manufacturers, midstream system integration and installation, and downstream application scenarios.

Upstream Components: As the core of energy storage equipment, batteries are the most concerned by the market.

The competition in power conversion systems (PCS), battery management systems (BMS), and energy management systems (EMS) is mainly reflected in conversion efficiency, battery management, grid interaction, etc., which will reflect long-term competitiveness and is expected to incubate fine-grained sub-market. At the current stage, the value of the battery part is the highest, which belongs to the core link of the energy storage industry chain; the cost of the PCS part is not high but the importance is relatively high, and there are certain barriers. Most of the main participating companies are photovoltaic inverter companies, and the competition pattern is stable. PCS's unit value and unit profit are higher than those of photovoltaic inverters; the software part BMS and EMS are still in their infancy, but they have the characteristics of high gross profit. In the long run, EMS's ability to manage energy consumption and BMS's management of battery health capability is the key to distinguishing the advantages and disadvantages of energy storage systems. It will reflect long-term competitiveness and is expected to incubate market segments.

Midstream Integration: The competition between software level and long-term operation ability

At present, energy storage system integrators who have the right to speak in channels and core components will have a certain advantage, but future competition is not limited to hardware integration capabilities but also lies in the software level and long-term operational capabilities. Integrators, as the segment with the fastest volume, receive the most attention in the midstream. Integrators who have the right to speak about core components have strong profitability at this stage; integrators who are beginning to show economies of scale and have channel advantages are conducive to seizing a higher market share. As the energy storage industry is still in a period of rapid development, relevant markets and policies are still being opened up, and the competitive landscape is far from certain. In the future, the core barriers for integrators lie not only in hardware integration, but also in software algorithms, interaction with power grids, and understanding of downstream applications.

Downstream Applications: Great Investment Value

the user side already has investment value at present and has a broad market prospect; the power generation side and grid side will also have corresponding investment value in the future with the guidance of policies and the enrichment of business models. In the near future, investment should focus on user-side energy storage, because it has the highest economic value and rich business models at this stage. In the short term, the widening of the peak-to-valley electricity price difference has made distributed energy storage a good investment value. At present, the investment entities of user-side energy storage also tend to be diversified. State-owned enterprises, private enterprises, industrial and commercial owners, local energy funds, foreign trade logistics real estate funds, etc. have all begun to try to invest in user-side energy storage projects. In the future, with the continuous improvement and maturity of the electricity market trading mechanism, it is expected to bring greater profit space. The energy storage volume on the power generation side is relatively large, and the driving factor is mainly the policy requirements for new energy power generation and storage. On the power generation side, large-scale projects costing hundreds of millions of dollars are more preferred to be led by large listed companies, with high entry barriers, low gross profit levels, and low investment returns at this stage. Grid-side energy storage has higher technical barriers, which may bring higher profit levels. Grid-side energy storage has not incorporated energy storage costs into power transmission and distribution prices, and investment has stagnated recently. In the future, when the ancillary service market matures, it will have higher returns. However, independent energy storage companies also need to consider how to cooperate with grid companies.

- 3C batteries (1)

- 48C Advanced Energy Project Credits (1)

- ActiveBalancing (1)

- Advanced Storage Solutions (1)

- advanced technologies (1)

- African market (1)

- AI Algorithms (1)

- AI in Energy Storage (1)

- air conditioning (1)

- All-in-One Energy Storage (1)

- American electricity market (1)

- ancillary services market (1)

- application scenarios (2)

- Arnstadt (1)

- automotive industry (1)

- backup generators (1)

- Backup power (1)

- batteries (2)

- Battery Discharge (1)

- Battery Energy Storage (1)

- Battery Energy Storage Systems (1)

- Battery Energy Storage Systems (BESS) (1)

- battery factory (1)

- battery industry event (1)

- battery management system (3)

- battery management systems (1)

- battery market (1)

- battery materials (1)

- battery pack (1)

- Battery Storage Safety (1)

- Battery technologies (1)

- battery technology advancements (1)

- battery type (1)

- BatteryLongevity (1)

- BatteryManagementSystem (1)

- BatterySafety (1)

- BatteryTechnology (1)

- BESS (1)

- Birmingham Exhibition (1)

- BMSArchitecture (1)

- Brazil energy storage (1)

- Burkina Faso (1)

- Capacity (1)

- capacity rule (1)

- carbon management (1)

- carbon neutrality goals (1)

- CATL (1)

- CE marking (1)

- certification (1)

- certifications (1)

- Charge Current (1)

- Charge/Discharge Rate (1)

- Chemical Storage (1)

- China electricity market (1)

- China International Battery Fair (1)

- CIBF 2023 (1)

- Clean energy (6)

- clean energy incentives (1)

- Clean Energy Revolution (1)

- clean energy solutions (1)

- Climate Goals (1)

- Climate Legislation (1)

- Commercial (1)

- Commercial Energy Storage (2)

- CompleteCurrentControl (1)

- Compressed Air Energy Storage (CAES) (1)

- consumer batteries (1)

- Containerized Energy Storage (1)

- Continuous Discharge Duration (1)

- conversion efficiency (1)

- Cooperation (1)

- cost composition (1)

- cost parity (1)

- cost reduction (1)

- Cost-effective storage (1)

- critical power (2)

- CSA certification (1)

- Customized Energy Storage (1)

- DC bus voltage (1)

- Decarbonization (1)

- Decarbonized future (1)

- Demand Forecasting (1)

- Department of Energy (1)

- DesignConsiderations (1)

- development strategies (1)

- Direct Pay (1)

- Discharge Current (1)

- discharge curve (1)

- Distributed Energy (1)

- Dongguan Lithium Valley (2)

- dual carbon goal (1)

- Dubai World Trade Center (1)

- efficient energy storage (1)

- Electric Vehicle Charging (1)

- Electric Vehicles (2)

- Electricity Costs (1)

- Electricity Infrastructure Operations Center (1)

- electricity market (1)

- electricity price mechanism (1)

- electricity prices (1)

- electricity supply (1)

- electrochemical energy storage (1)

- Electrochemical Storage (1)

- Energy Certification (1)

- Energy Community Adder (2)

- energy companies (1)

- energy consumption (1)

- energy consumption management (1)

- energy crisis (1)

- Energy Demand (1)

- Energy Demands (1)

- energy density (2)

- energy distribution (1)

- Energy Efficiency (1)

- energy industry (1)

- Energy Industry Solutions (1)

- energy investment (1)

- Energy Landscape (1)

- Energy Management System (3)

- energy management systems (1)

- energy professionals (1)

- energy sector (1)

- energy solutions (2)

- Energy storage (16)

- Energy Storage Batteries (3)

- Energy storage battery business (1)

- Energy Storage Battery Industry (1)

- Energy Storage Battery Technology (1)

- energy storage business model (1)

- Energy Storage Cabinets (1)

- energy storage capacity (1)

- Energy Storage Certification (1)

- Energy Storage Challenges (1)

- energy storage components (1)

- energy storage converters (1)

- energy storage equipment (1)

- Energy Storage Incident (1)

- energy storage industry (4)

- energy storage market (1)

- Energy Storage Products (1)

- energy storage profitability (1)

- energy storage projects (1)

- Energy storage research (1)

- Energy Storage Solution (2)

- Energy Storage Solutions (4)

- Energy Storage System (3)

- energy storage system solutions (1)

- Energy Storage Systems (5)

- Energy Storage Technologies (2)

- Energy Supplies (1)

- Energy Supply Challenges (1)

- Energy Transition (1)

- energy trends (1)

- EnergyEfficiency (1)

- EnergyStorage (1)

- Environmental Innovation (1)

- environmental sustainability (1)

- ESS chain (1)

- EU countries (1)

- European battery factory (1)

- European electricity market (1)

- European Market (1)

- European Solar Market (1)

- Exhibitors (1)

- Extended Tax Credits (1)

- field study (1)

- financing options (1)

- fire protection systems (1)

- Flexibility (2)

- Flow batteries (2)

- Flywheel Energy Storage (1)

- Fossil Fuel Emissions (1)

- fossil fuels (1)

- generation side (1)

- Germany (2)

- Gigawatts (1)

- Global Carbon Emissions (1)

- global energy storage (1)

- global market share (1)

- global power batteries (1)

- government officials (1)

- Government Support (1)

- granular silicon (1)

- Green Energy Initiatives (1)

- Green Living (1)

- Green Technology (2)

- Greenhouse Gas Emission Verification (1)

- grid (1)

- Grid reliability (2)

- grid resilience (1)

- grid side (1)

- Grid Stability (3)

- Grid Storage Launchpad (1)

- grid voltage (1)

- grid-connected (1)

- Guide (1)

- high-voltage battery (1)

- higher discharge rate (1)

- Home Energy Storage (3)

- Home Energy Storage Benefits (1)

- household energy storage (2)

- hydropower (1)

- I&C energy storage (1)

- IEC 62619 (2)

- IEEE 1547 (1)

- inductive loads (1)

- Industrial (1)

- industrial and commercial energy storage (1)

- industrial and commercial track (1)

- Industrial Energy Storage (6)

- Industry Trends (1)

- IndustryStandards (1)

- Inflation Reduction Act (1)

- Inflation Reduction Act (IRA) (1)

- installed energy storage (1)

- integrated energy storage cabinet (1)

- integration (1)

- intelligent solutions (1)

- Intermittency (1)

- International Energy Agency (1)

- International Energy Agency (IEA) (1)

- International Energy Storage Exhibition (1)

- Intersolar (1)

- Intersolar Europe 2023 (1)

- Intersolar Middle East (1)

- Intertek (1)

- inverter (2)

- inverter power (1)

- Investment (1)

- Investment Tax Credits (1)

- ISO 14001 (1)

- ISO 9001 (1)

- ITC (1)

- Johannesburg (1)

- large size silicon (1)

- large-scale energy storage (1)

- Leveraging Solar Power (1)

- life cycles (1)

- LiFePO4 batteries (1)

- lithium batteries (1)

- lithium iron phosphate batteries (2)

- Lithium Prices (1)

- Lithium Valley (14)

- Lithium Valley Products (1)

- Lithium Valley Technology (1)

- Lithium-ion alternatives (1)

- Lithium-Ion Batteries (3)

- lithium-ion battery cells (1)

- lithium-ion voltage (1)

- load capacity (1)

- Long Beach California (1)

- Long Duration Energy Storage (1)

- Long-duration storage (2)

- Low-carbon Future (1)

- low-voltage battery (1)

- LS Energy Solutions (1)

- M&A project (1)

- manufacturing equipment (1)

- Market Opportunities (1)

- market-oriented (1)

- Mechanical Storage (1)

- MEE (1)

- merger agreement (1)

- Microgrids and Distributed Energy (1)

- Middle East Energy Summit (1)

- Mobile Energy Storage (1)

- Multiple-MPPT (1)

- Na+ battery (1)

- Net Zero Emissions (2)

- Netherlands (1)

- new energy battery technology (1)

- Next-generation batteries (1)

- North America (1)

- NREL (1)

- off-grid (1)

- oil and gas (1)

- operating efficiency (1)

- optical storage (1)

- Pacific Northwest National Laboratory (1)

- PassiveBalancing (1)

- Peak Times (1)

- peak-valley price difference (1)

- Photovoltaic (PV) Solar Power (1)

- photovoltaic components (1)

- photovoltaic installations (1)

- plug-and-play (1)

- policy certainty (1)

- polysilicon (1)

- power batteries (1)

- power battery company (1)

- power battery developments (1)

- power conversion system (1)

- power density (1)

- Power Generation (2)

- power match (1)

- power supply (1)

- power system (1)

- power systems (1)

- power transmission (1)

- Power/Energy (1)

- Predictive Analytics (1)

- Product Carbon Footprint Certificate (1)

- product line (1)

- product upgrades (1)

- production capacity (2)

- production process (1)

- profit model (1)

- Pumped Hydro Storage (1)

- quality management system (1)

- R&D team (1)

- raw materials (1)

- regional energy transformation (1)

- Reliability testing (1)

- Reliable Power Supply (1)

- renewable energy (18)

- renewable energy capacity (1)

- Renewable Energy Industry (1)

- Renewable energy integration (2)

- renewable energy investment (1)

- renewable energy policies (1)

- renewable energy production (1)

- Renewable Energy Revolution (1)

- Renewable Energy Solutions (1)

- renewable energy sources (1)

- Renewable Energy Storage (1)

- RenewableEnergy (1)

- renewables sector (1)

- Residential & Commercial Energy Storage (1)

- residential energy storage (2)

- rural energy storage (1)

- safer energy storage (1)

- Sandton Convention Centre (1)

- Scalability (1)

- service life (1)

- shadow scan function (1)

- signing ceremony (1)

- silicon materials (1)

- silicon wafers (1)

- single-cluster battery management (1)

- Single-MPPT (1)

- smarter energy storage (1)

- SNEC Exhibition (1)

- Sodium-ion batteries (1)

- Sodium-ion Battery (1)

- Solar & Storage Live 2023 (1)

- Solar Capacity (1)

- solar cells (1)

- Solar Energy (2)

- Solar Energy Industry (2)

- solar energy products (1)

- solar energy storage (1)

- Solar Energy Technologies (1)

- Solar Generation (1)

- Solar Installations (1)

- solar integration (1)

- solar modules (1)

- solar panel energy storage (1)

- solar power (2)

- Solar PV (1)

- Solar Show Africa 2023 (1)

- Solar Sustainability (1)

- solar trends (1)

- Solar-Plus-Storage Integration (1)

- Solid-State Batteries (1)

- South African Minister of Energy (1)

- Stacked High-Voltage Battery (1)

- standardization (1)

- StateEstimation (1)

- Storage Installations (1)

- Storage Ratio (1)

- Storage Systems (1)

- Strategy Director (1)

- SUMEC (1)

- Supplier Conference (1)

- supply chain cost (1)

- Supply Chain Traceability (1)

- surge power (1)

- Surplus Energy (1)

- Sustainability (1)

- Sustainable Development (1)

- Sustainable Energy (2)

- Sustainable Future (1)

- Sustainable Power Grid (1)

- sustainable power solutions (1)

- Sustainable Practices (1)

- Sustainable Technology (1)

- SustainableEnergy (1)

- system structure (1)

- TD (1)

- technical components (1)

- Technological Innovation (2)

- technology exchange (1)

- Temporary Power Solutions (1)

- ternary lithium batteries (1)

- Thermal Storage (1)

- Thuringia (1)

- Transferability (1)

- transparent reporting (1)

- TUV certification (1)

- Types of Energy Storage Systems (1)

- UK (1)

- UK Legislation (1)

- UL 1973 (2)

- UL 9540A (1)

- US Federal Government (1)

- US manufacturers (1)

- US public investments (1)

- user side (1)

- Utilities (1)

- voltage match (1)

- wholesale market (1)

- Wind Capacity (1)

- Wind Energy (1)

- Wind Generation (1)

- Wind Installations (1)

- wind power (1)

- winter energy demand (1)

- Zero Emissions (1)

- Zonsen Power (1)

- ZZonsen Power (1)